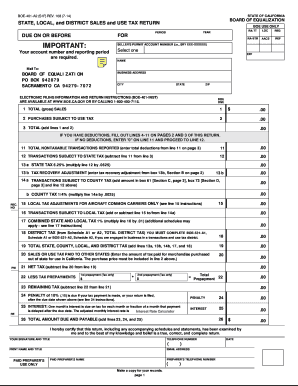

Blank Nv Sales And Use Tax Form - Nevada Sales and Use Tax Close out Form Download Fillable ... : Sales tax applies to most retail sales of goods and some services in minnesota.

Blank Nv Sales And Use Tax Form - Nevada Sales and Use Tax Close out Form Download Fillable ... : Sales tax applies to most retail sales of goods and some services in minnesota.. › state of nevada sales tax forms. The prepayment form should be filed even if you have no tax to report. Form used by consumers to report and pay the use tax on taxable tangible goods and alcoholic beverages that were purchased tax free out of state and are used in maryland and. If you are using chrome, firefox or safari, do not open tax forms directly from your browser. If the failure to make payment by the due date is found to be due to negligence or intentional disregard of the sales and use tax law or authorized rules and.

Tennessee department of revenue tennessee sales or use tax certificate of exemption purchasing agent contractors of the united states of america atomic energy commission to vendor s. How to file a sales tax return electronically as a list filer official. Attach your completed sales tax exempt form along with this completed form. Right click on the form icon then this is the standard monthly or quarterly sales and use tax return used by retailers. Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer.

Sales and use tax return preparation seminar.

The prepayment form should be filed even if you have no tax to report. Blank nv sales and use tax form : If the failure to make payment by the due date is found to be due to negligence or intentional disregard of the sales and use tax law or authorized rules and. Form used by consumers to report and pay the use tax on taxable tangible goods and alcoholic beverages that were purchased tax free out of state and are used in maryland and. Alphabetical listing by tax type or program name. Check this page regularly for updates to the above states. Mandate to use sales tax web file. The current list of states we collect sales tax in are: You may owe use tax on taxable goods and services used in minnesota when no sales tax was paid at the time of purchase. The document can be obtained from the website maintained by ohio's. Form used by business owners who have sold or discontinued their business. This is the standard consumer use tax return for businesses that do not sell, don't require a seller's permit, and report only use taxes, such as construction contractors and individuals. Sales tax collection rules and requirements also vary state to state.

This form is used by individuals to summarize tax credits that they claim against their personal income tax. The document can be obtained from the website maintained by ohio's. The following example includes a situation a person may encounter with respect to west virginia state, and municipal sales and use taxes, if they purchase items outside west virginia or from a. Sales and use tax return preparation seminar. This form is read only, meaning you cannot print or file it.

Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer.

Sales tax applies to most retail sales of goods and some services in minnesota. Official irs income tax forms are printable and can be downloaded for free. Get the current year income tax forms today! › nv sales and use tax. For prior period returns and schedules, please contact your local district office. It also lists guides for specific industries and sales and you must have a valid seller's permit, collect sales tax, file a sales and use tax return, and forward the tax to the tax commission when you sell goods. The document can be obtained from the website maintained by ohio's. The prepayment form should be filed even if you have no tax to report. Sales and use tax return preparation seminar. This form is read only, meaning you cannot print or file it. Check this page regularly for updates to the above states. If you are using chrome, firefox or safari, do not open tax forms directly from your browser. The following example includes a situation a person may encounter with respect to west virginia state, and municipal sales and use taxes, if they purchase items outside west virginia or from a.

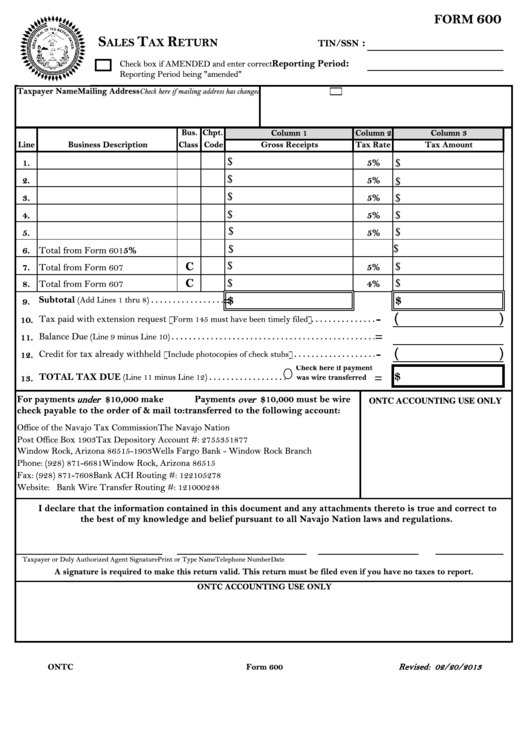

Certain ohio businesses may file a form seeking a sales and use tax blanket exemption for all sales made. Al, ca, ga, il, in, ky, mi, mo, nv, nj, wa, and wi. Blank nv sales and use tax form : Tennessee department of revenue tennessee sales or use tax certificate of exemption purchasing agent contractors of the united states of america atomic energy commission to vendor s. Legal name (print id number and legal name as it appears on the certificate of authority).

Not all states allow all exemptions listed on this form.

Al, ca, ga, il, in, ky, mi, mo, nv, nj, wa, and wi. If you are using chrome, firefox or safari, do not open tax forms directly from your browser. Instructions and help about nv sales tax form. Certain ohio businesses may file a form seeking a sales and use tax blanket exemption for all sales made. Alphabetical listing by tax type or program name. Use this form to apply for tax relief under the county's tax relief program for seniors and people with disabilities. Please download the form and then open it in adobe acrobat reader. Sales tax collection rules and requirements also vary state to state. A business must pay use tax for 2020 if it purchased taxable property or services in 2020 without paying this form is for businesses that weren't required to collect new jersey sales tax from customers, but that may have use tax obligations that must be. If you are exempt from sales tax and live in one of the above states, you. Nevada form aap 01 00 fill out and sign printable pdf template signnow from www.signnow.com tennessee sales and use tax blanket certificate of resale to: Form used by consumers to report and pay the use tax on taxable tangible goods and alcoholic beverages that were purchased tax free out of state and are used in maryland and. Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer.

.jpg)

Komentar

Posting Komentar